39 what is a non qualified retirement plan

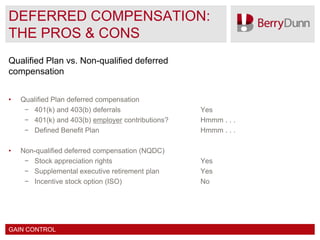

Nonqualified Deferred Compensation Plans (NQDCs ... NQDC plans (sometimes known as deferred compensation programs, or DCPs, or elective deferral programs, or EDPs) allow executives to defer a much larger portion of their compensation and to defer taxes on the money until the deferral is paid. Deferred comp and you A Guide to Common Qualified Plan Requirements | Internal ... Under Code section 410 (a) (4), a plan is not qualified unless it provides that an employee who is otherwise eligible to participate under the terms of the plan commences participation no later than the earlier of:

Plan Services | Fiduciary Outsourcings Services ... Retirement Plan & Fiduciary Solutions. Fiduciary Solutions; Flexible Plans & Partnerships; TPA & 3(16) Solutions; MEPs PEPs & GoPs Solutions; Consulting Solutions; Retirement Plan Solutions Team; What Our Clients Have to Say About Us; Non-Qualified Plan & Benefits Financing Solutions. Our Non-Qualified Retirement Plan Solutions; Our Benefits ...

What is a non qualified retirement plan

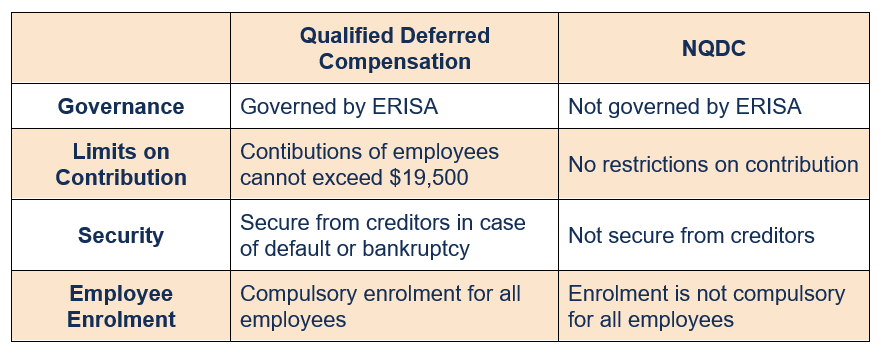

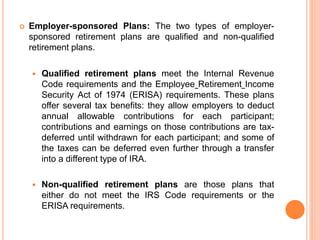

What Is a NonQualified Retirement Plan? - Experian Experian Consumer Support Credit Advice Global Sites Check Your FICO® Score for Free Get Your FICO® Score Sign Skip main content Reports Scores Identity Theft Protection Marketplace Credit Support Education Sign Free Credit Report Free Credit... Non-Qualified Plan - Overview, How It Works, Types Non-Qualified Plan What is a Non-Qualified Plan? A non-qualified plan is an employer-sponsored, tax-deferred retirement savings plan that falls outside the Employment Retirement Income Security Act (ERISA). Unlike qualified plans, non-qualified plans are exempt from the regulations and testing that apply to qualified plans. › qualified-vs-non-qualifiedQualified vs. Non-Qualified Plans: What's the Difference? Non-qualified plans are still part of your retirement package, but they don't come with all the same rules as qualified plans. The good news is that these plans often still allow employees to defer taxes until retirement, but they aren't deductible to the employer. And the employee sometimes has to pay taxes on the contributions right away.

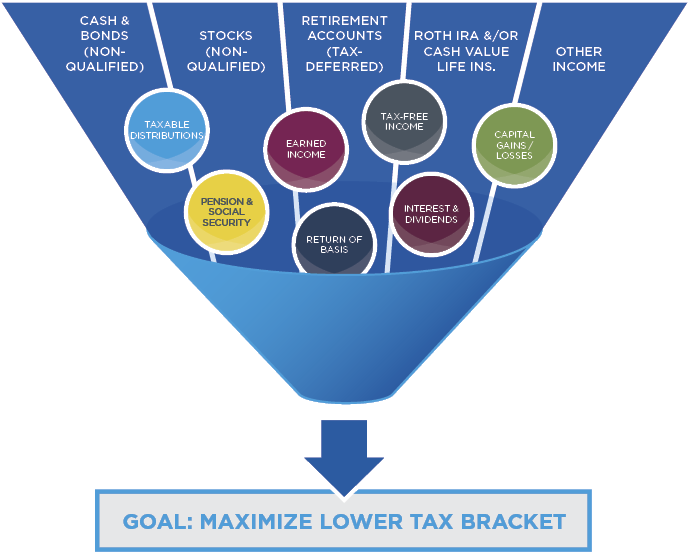

What is a non qualified retirement plan. How Are Annuities Taxed? - ValueWalk An annuity will not provide additional tax-deferral benefits for a retirement plan or IRA if it is held to fund the retirement plan or IRA. Non-qualified annuities. Funding. The growth of nonqualified annuities is tax-deferred and funded with after-tax dollars. Distributions. The Required Minimum Distribution does not apply to non-qualified ... merrillconnect.iscorp.com › nlg › viewDocumentAnnuity & Qualified Retirement Plan Insurance Withdrawal ... Section 4 - For Qualified Accounts Only (Not applicable to IRAs or Non Qualified accounts) 4a. Qualifying Events - May require proof of eligibility: Attainment of age 59½ (70½ for 457(b) gov't plans) Separated from employment. Employer Terminated Retirement Plan Active-Duty Reservist. Disabled Unforeseeable Emergency/Financial Hardship. Nonqualified Plan Definition A nonqualified plan is a type of tax-deferred, employer-sponsored retirement plan that falls outside of Employee Retirement Income Security Act (ERISA) guidelines. Nonqualified plans are designed... Non-Qualified Annuity: The After-Tax Retirement Annuity (2022) What is a Non-Qualified Annuity? A non-qualified annuity is a retirement plan that you pay for with after-tax money. Non-qualified annuities are not tax-deductible. Also known as the "after-tax retirement annuity." Table Of Contents What is a Non-Qualified Annuity? Non-Qualified Annuity Features and Benefits Non-Qualified Annuities At A glance

What Does "Nonqualified Retirement Plan" Mean? | Finance ... A "nonqualified" retirement plan is an account that may be offered by your employer (or an account that's offered by a plan administrator), which does not hold tax-deferred money in your account;... ttlc.intuit.com › community › retirementIs military retirement pay from a qualified or nonqualified plan Jun 01, 2019 · Military retirement is considered a non-qualified plan. The term "qualified retirement plan" applies to plans covered by the Employee Retirement Income Security Act, or ERISA. ERISA only covers private sector retirement plans. The law does not cover public sector pensions including federal government plans such as the military retirement system. Qualified vs. Non-Qualified Benefit Plans Non-qualified plans are employee benefit plans that do not meet ERISA guidelines, leaving a more flexible plan with a variety of possibilities for employees. What is a Non-Qualified Retirement Plan? (with pictures) Non-qualified retirement plans are deferred compensation plans that allow the employee to delay receiving earned wages and income until a later date. The employer is charged with the responsibility of maintaining the deferred income in a special fund until the employee retires or otherwise leaves the company.

› ira-qualified-planIs an IRA a Qualified Plan? - Investopedia Dec 13, 2021 · A qualified retirement plan is an investment plan offered by an employer that qualifies for tax breaks under the Internal Revenue Service (IRS) and ERISA guidelines. How Are Annuities Taxed? Additional considerations. An annuity will not provide additional tax-deferral benefits for a retirement plan or IRA if it is held to fund the retirement plan or IRA. Non-qualified annuities. Funding. What Is a NonQualified Retirement Plan? - Experian Most of us are familiar with 401(k)s, which is a type of qualified retirement plan. But to attract and retain key employees and senior management, employers sometimes offer nonqualified retirement plans designed for high-earning executives. Implementation Project Specialist Non-Qualified Retirement ... Position: Implementation Project Specialist for Non-Qualified Retirement PlansWho We Are:Newport helps companies offer their associates a more secure financial future through retirement plans, insurance and consulting services. Newport offers comprehensive plan solutions and consulting expertise to plan sponsors and the advisors who serve them. As a provider and ...

Qualified Retirement Plan: What Is It & How It Works ... Examples of non-qualified plans include an individual retirement account, deferred compensation plan, 457 (b) plan, split dollar life insurance, salary deferral, Roth IRA or executive benefit plan. When it comes to contribution limits, those will vary by plan type.

Relationship Manager for Non-Qualified Retirement Plans ... Newport offers comprehensive plan solutions and consulting expertise to plan sponsors and the advisors who serve them. As a provider and partner, Newport is independent, experienced and responsive. JOB SUMMARY: The Non-Qualified Relationship Manager manages multiple large and complex accounts, some of which are across multiple business lines.

› terms › qQualified Retirement Plan - Investopedia Sep 24, 2020 · A qualified retirement plan meets the requirements of Internal Revenue Code Section 401(a) of the Internal Revenue Service (IRS) and is thus eligible to receive certain tax benefits, unlike a non ...

Qualified vs Non Qualified Retirement Plans: What's the ... One popular type of Non Qualified Retirement Plan is an annuity. An annuity can be classified as "Non Qualified" money, but can grow "tax deferred" just like Qualified money. In other words, all of your earnings on an Non Qualified annuity will NOT trigger an annual 1099 tax form from the annuity company.

Nonqualified plans can help select employees to save more A nonqualified retirement plan is one that's not subject to the Employee Retirement Income Security Act of 1974 (ERISA). Most nonqualified plans are deferred compensation arrangements, or an agreement by an employer to pay an employee in the future.

Nonqualified Retirement Plans: What Are They? | The Motley ... Nonqualified retirement plans are employer-sponsored retirement plans that aren't subject to the rules laid out in the Employee Retirement Income Security Act of 1974 (ERISA). This law created...

What is a Non-Qualified Retirement Plan? Companies use non-qualified retirement plans as a recruitment and retention tool for these employees because they allow them to defer compensation that exceeds limits for the general employee base. Employees should pay particular heed to the structure of non-qualified plans to ensure they meet their needs and expectations for retirement planning.

Qualified vs. Nonqualified Retirement Plans: What's the ... What Is a Nonqualified Retirement Plan? Many employers offer primary employees nonqualified retirement plans as part of a benefits or executive package. 4 Nonqualified plans are those that are...

Non-Qualified Retirement Plan: Types & Examples | Study.com A non-qualified retirement plan is a retirement program that doesn't meet Employer Retirement Income Security Act (ERISA) standards. An ERISA qualified account would include a typical retirement...

What Is The Difference Between Qualified And Non-Qualified ... In short, qualified pension plans are the most common type of retirement plan and are given more preferential treatment in the tax code. Non-qualified plans, on the other hand, have much less stringent requirements and consequently less favorable tax treatment.

Non-Qualified Retirement Plan - Definition, Benefits ... Non-Qualified Retirement Plan - Definition, Benefits & Examples By Mark Cussen Date September 14, 2021 Millions of employees save for retirement by deferring a portion of their compensation into an employer-sponsored, tax-deferred savings plan.

You've Gotten Rich Working for 1 Company - But It's Time ... Similar to a qualified 401(k) plan, pre-tax contributions are made to the plan and grow tax-deferred until a point in the future, often retirement, where the distributions are taxable to the employee.

Qualified Retirement Plans: What Are They? | The Motley Fool Learn what defines a qualified retirement plan and what sets it apart from non-qualified plans. Consider how a person benefits from having a qualified plan.

What is a non qualified pension plan Non-qualified plans are retirement savings plans. They are called non-qualified because they do not adhere to Employee Retirement Income Security Act (ERISA) guidelines as with a qualified plan. Non-qualified plans are generally used to supply high-paid executives with an additional retirement savings option.

› retirement-plans › plan-participantRetirement Topics - Qualified Joint and Survivor Annuity ... Sep 28, 2021 · A qualified plan like a defined benefit plan, money purchase plan or target benefit plan PDF must provide a QJSA to all married participants as the only form of benefit unless the participant and spouse, if applicable, consent in writing to another form of benefit payment. This consent can be submitted to the plan within 90-days of when annuity ...

› qualified-vs-non-qualifiedQualified vs. Non-Qualified Plans: What's the Difference? Non-qualified plans are still part of your retirement package, but they don't come with all the same rules as qualified plans. The good news is that these plans often still allow employees to defer taxes until retirement, but they aren't deductible to the employer. And the employee sometimes has to pay taxes on the contributions right away.

Non-Qualified Plan - Overview, How It Works, Types Non-Qualified Plan What is a Non-Qualified Plan? A non-qualified plan is an employer-sponsored, tax-deferred retirement savings plan that falls outside the Employment Retirement Income Security Act (ERISA). Unlike qualified plans, non-qualified plans are exempt from the regulations and testing that apply to qualified plans.

What Is a NonQualified Retirement Plan? - Experian Experian Consumer Support Credit Advice Global Sites Check Your FICO® Score for Free Get Your FICO® Score Sign Skip main content Reports Scores Identity Theft Protection Marketplace Credit Support Education Sign Free Credit Report Free Credit...

0 Response to "39 what is a non qualified retirement plan"

Post a Comment