42 generally accepted accounting principles

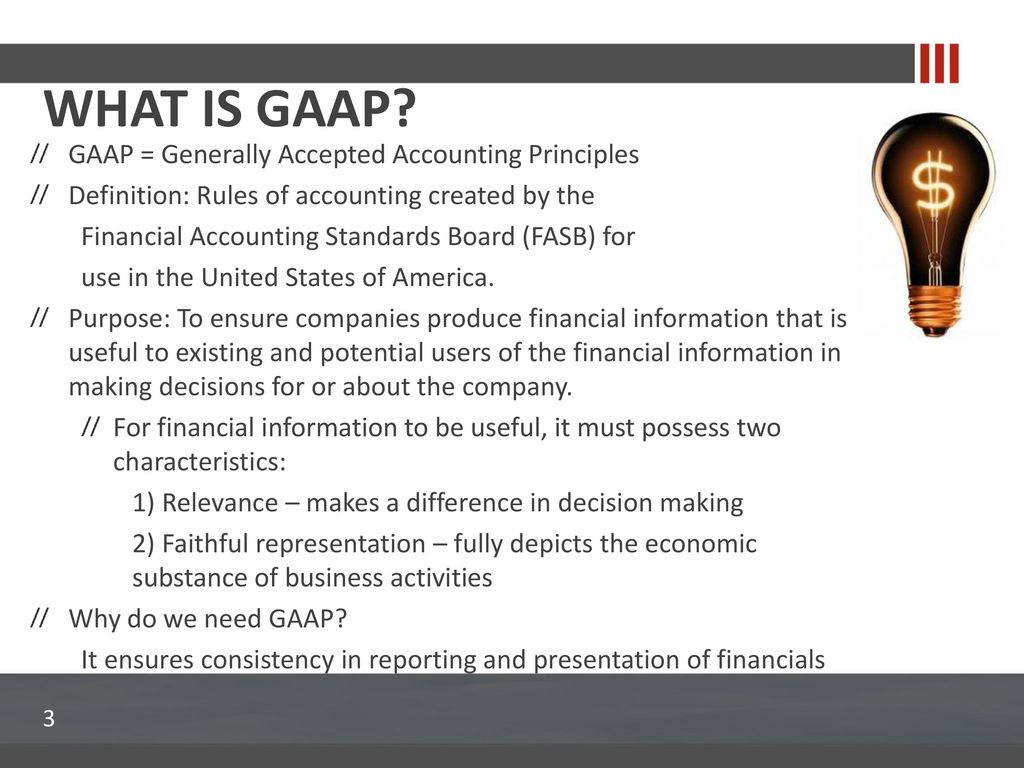

Accounting Principles Definition Generally Accepted Accounting Principles (GAAP) GAAP is a common set of generally accepted accounting principles, standards, and procedures that public companies in the U.S. must follow when they ... Generally Accepted Accounting Principles.docx - Generally ... Generally Accepted Accounting Principles GAAP-comprises the accounting principles and processes, standards and underlying assumptions that are used in preparing financial statements Financial Reporting Standards Council (FRSC)-official accounting standard setting body in the Philippines. The primary task of FRSC is to improve and establish accounting standards that will be generally accepted ...

Generally Accepted Accounting Principles | Business Paper ... Generally Accepted Accounting Principles. Financial statements provide information on the financial condition, operations results, and changes in its financial state. It should contain information about the enterprise's assets and liabilities, the consequences of actions, events, and circumstances. This information is needed by a wide range ...

Generally accepted accounting principles

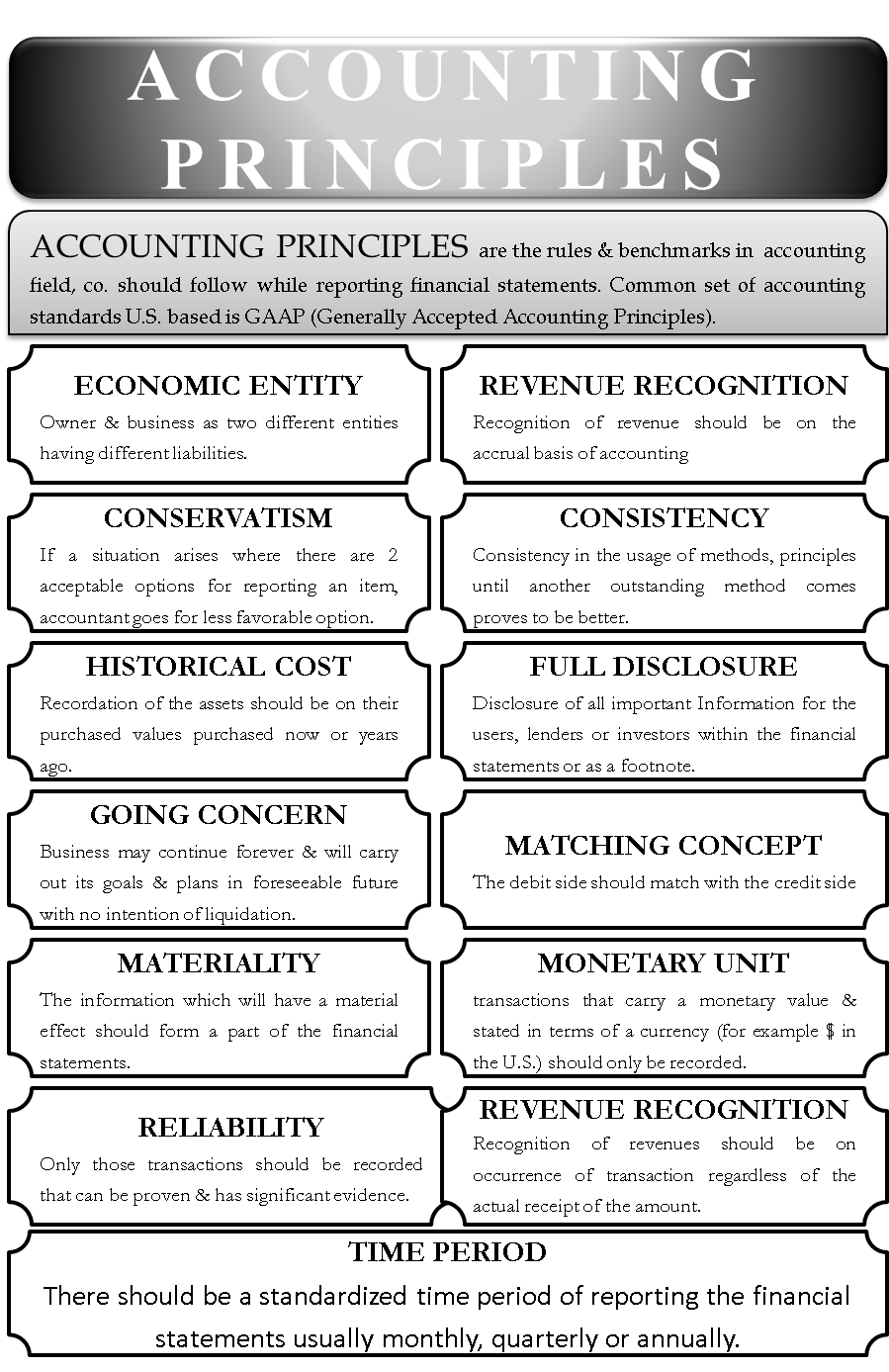

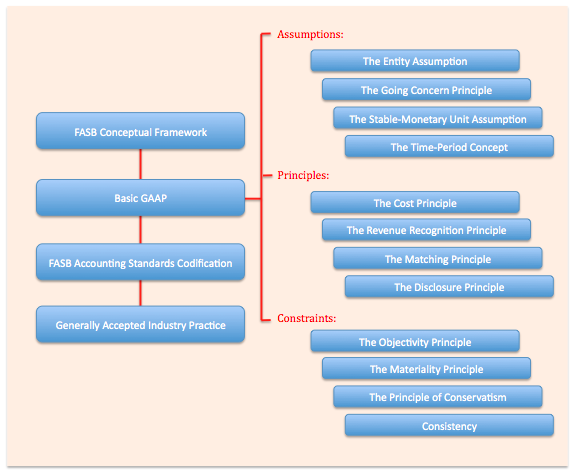

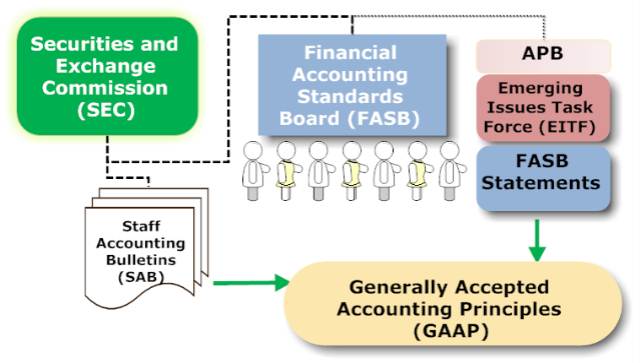

PDF General Accepted Accounting Principles Accounting Reference Four Basic Principles The four basic principles in generally accepted accounting principles are: cost, revenue, matching and disclosure. The cost principle refers to the notion that all values listed and reported are the costs to obtain or acquire the asset, and not the fair market value. The Generally Accepted Accounting Principles (GAAP) Definition 10 Principles of GAAP There are 10 general concepts that lay out the main mission of GAAP. 1. Principle of Regularity The accountant has adhered to GAAP rules and regulations as a standard. 2.... Generally Accepted Accounting Principles (United States ... The Financial Accounting Standards Board (FASB) published U.S. GAAP in Extensible Business Reporting Language (XBRL) beginning in 2008. Contents 1 History 2 Basic concepts 2.1 Assumptions 2.2 Principles 2.3 Constraints 3 Required departures from GAAP 4 Involved in development 5 Precedence of GAAP-setting authorities

Generally accepted accounting principles. 80.20 - Generally Accepted Accounting Principles an organization has a financial benefit or burden relationship with the primary government if, for example, any one of these conditions exists: (1) the primary government is legally entitled to or can otherwise access the organization's resources; (2) the primary government is legally obligated or has otherwise assumed the obligation to finance … French generally accepted accounting principles - Wikipedia The French generally accepted accounting principles, called Plan Comptable Général (PCG) is defined by the regulation n°2014-03 written by the Authority of Accounting Rules (Autorité des normes comptables, abbr. ANC), validated by the Minister of the Budget. The Authority of Accounting Rules was created by the ordonnance no 2009-79 and combines the functions of … What Is Generally Accepted Accounting Principles Gaap And ... A system known as the Generally Accepted Accounting Principles defines four basic assumptions, four basic principles and four basic constraints to business accounting. The four basic principles of GAAP deal with the way that money flows into and out of the business as well as the way that this flow is documented. PDF The Hierarchy of Generally Accepted Accounting Principles ... The Hierarchy of Generally Accepted Accounting Principles, Including the Application of Standards Issued by the Financial Accounting Standards Board July 28, 2009 Introduction Purpose 1. The objective of this Statement is to identify the sources of accounting principles and the framework for selecting the principles used in the

Generally Accepted Accounting Principles (GAAP ... Generally accepted accounting principles, or GAAP, are standards that encompass the details, complexities, and legalities of business and corporate accounting. The Financial Accounting Standards Board (FASB) uses GAAP as the foundation for its comprehensive set of approved accounting methods and practices. Explore the Main Points Standards - FASB On July 1, 2009, the FASB Accounting Standards CodificationTM became the single official source of authoritative, nongovernmental U.S. generally accepted accounting principles (GAAP). Learn about the Codification and how to use it here. >> More Private Company Decision-Making Framework Standards & Guidance - fasab.gov The FASAB Handbook of Accounting Standards and Other Pronouncements, as Amended (Current Handbook) —an approximate 2,500-page PDF—is the most up-to-date, authoritative source of generally accepted accounting principles (GAAP) developed for federal entities. GAAP: Generally Accepted Accounting Principles Definition The Generally Accepted Accounting Principles (GAAP) consist of the sum of all decisions and opinions made by CAP, APB, and FASB over the years. The 10 Generally Accepted Accounting Principles. When referring to the GAAP accounting standards, there are 10 principles that guide companies in preparing financial statements: #1: Regularity

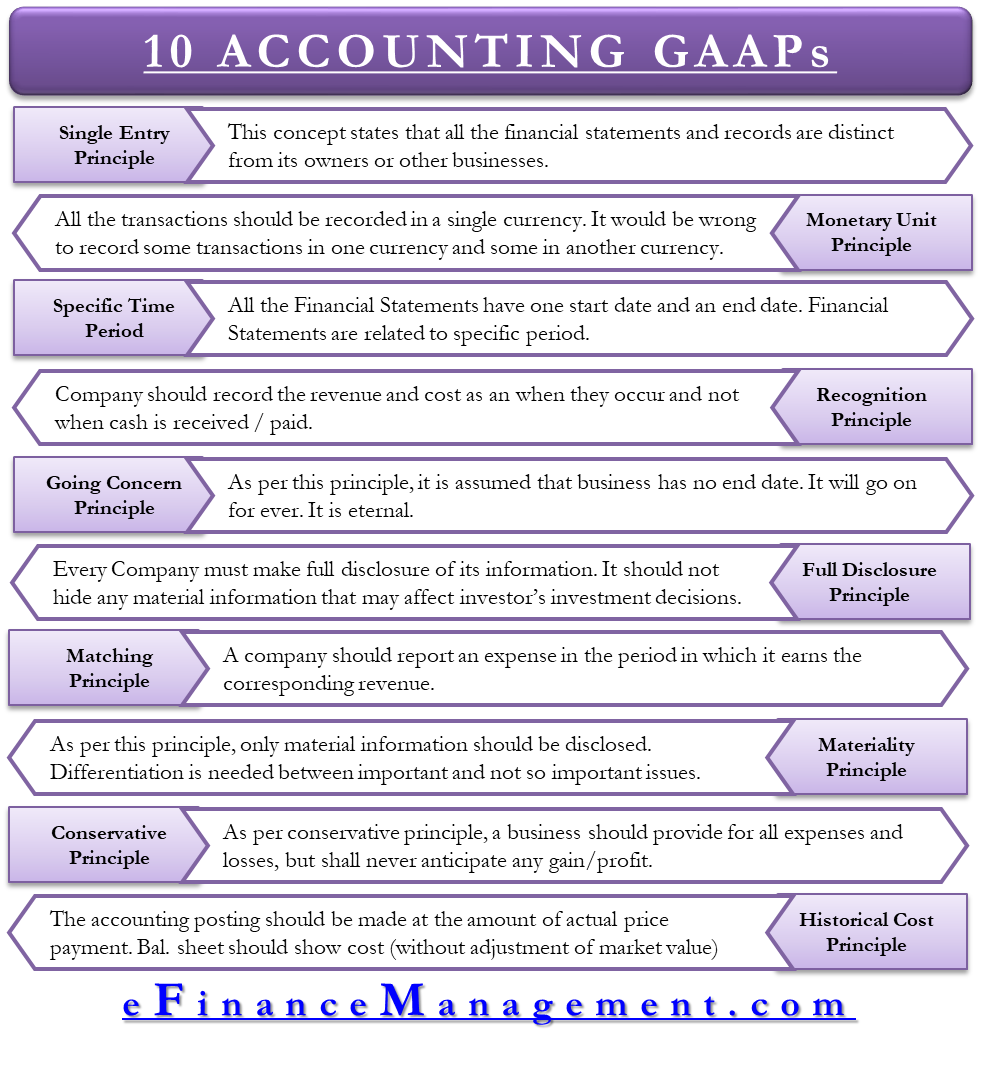

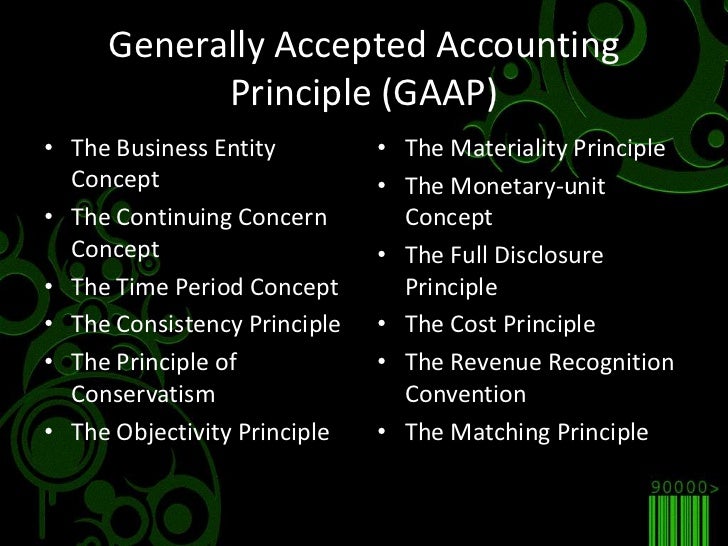

Generally Securities Accepted Accounting Principles ... Generally Securities Accepted Accounting Principles Assessment AnswerGenerally Securities Accepted Accounting PrinciplesThis paper gives an analysis of the accounting standards as required by International Financial Standards (IFRs) and US Generally Accepted Accounting Principles (GAAP) frameworks to compare methodologies of recording financial data and usefulness of, Buy Generally Securities ... What is GAAP? - AccountingTools GAAP is short for Generally Accepted Accounting Principles. GAAP is a cluster of accounting standards and common industry usage that have been developed over many years. It is used by organizations to: Properly organize their financial information into accounting records; Summarize the accounting records into financial statements; and. What Are the Generally Accepted Accounting Principles? The best way to understand the GAAP requirements is to look at the ten principles of accounting. 1. Economic Entity Principle The business is considered a separate entity, so the activities of a business must be kept separate from the financial activities of its business owners. 2. Monetary Unit Principle What are generally accepted accounting principles (GAAP ... The basic underlying accounting principles consist of the following: Economic entity assumption Going concern assumption Time period assumption Monetary unit assumption Cost principle or measurement principle Matching principle or expense recognition principle Revenue recognition principle Full disclosure principle Industry practices

About GAAP - Accounting Foundation GAAP includes principles on: Recognition —what items should be recognized in the financial statements (for example as assets, liabilities, revenues, and expenses) Measurement —what amounts should be reported for each of the elements included in financial statements,

› m › managerialaccountingManagerial Accounting Definition Oct 08, 2021 · Financial accounting must conform to certain standards, such as generally accepted accounting principles (GAAP). All publicly held companies are required to complete their financial statements in ...

What Are Generally Accepted Accounting Principles ... The 10 generally accepted accounting principles include economic entity, monetary unit assumption, cost principle, revenue recognition, matching principle, conservatism principle, time period principle, going concern principle, materiality principle, and full disclosure principle. What are generally accepted accounting principles quizlet?

GAAP – Generally Accepted Accounting Principles in the ... 9.10.2018 · It can’t be stressed enough that they are still only ‘generally accepted’ accounting principles, standards, and methods. While there is no doubt that they help to bring about more transparency and understanding when it comes to financial statements, this does not necessarily guarantee that they will ensure that the respective financial statements will be free of mistakes …

PDF Generally Accepted Accounting Principles - 2013 Generally Accepted Accounting Principles Accountants use generally accepted accounting principles (GAAP) to guide them in recording and reporting financial information. GAAP comprises a broad set of principles that have been developed by the accounting profession and the Securities and Exchange Commission (SEC). Two

Generally Accepted Accounting Principles Generally Accepted Accounting Principles Accountants use generally accepted accounting principles (GAAP) to guide them in recording and reporting financial information. GAAP comprises a broad set of principles that have been developed by the accounting profession and the Securities and Exchange Commission (SEC).

GAAP (Generally Accepted Accounting Principles) Generally Accepted Accounting Principles or GAAP is a defined set of rules and procedures that needs to be followed in order to create financial statements, which are consistent with the industry standards. GAAP helps in ensuring that financial reporting is transparent and uniform across industries.

US GAAP: Generally Accepted Accounting Principles Generally Accepted Accounting Principles (GAAP or US GAAP) are a collection of commonly-followed accounting rules and standards for financial reporting. The specifications of GAAP, which is the standard adopted by the U.S. Securities and Exchange Commission (SEC), include definitions of concepts and principles, as well as industry-specific rules.

GAAP: What Are 'Generally Accepted Accounting Principles ... Generally accepted accounting principles — or GAAP (pronounced "gap") for short — are a group of accounting standards that are used to prepare financial statements for companies, not-for-profit...

Generally Accepted Accounting Practice (UK) - Wikipedia Generally Accepted Accounting Practice in the UK, or UK GAAP, is the overall body of regulation establishing how company accounts must be prepared in the United Kingdom.Company accounts must also be prepared in accordance with applicable company law (for UK companies, the Companies Act 2006; for companies in the Channel Islands and the …

› accounting-principles-iAccounting Principles I - CliffsNotes CliffsNotes study guides are written by real teachers and professors, so no matter what you're studying, CliffsNotes can ease your homework headaches and help you score high on exams.

GAAP: Generally Accepted Accounting Principles | CFI The Generally Accepted Accounting Principles further set out specific rules and principles governing such things as standardized currency units, cost and revenue recognition Revenue Recognition Principle The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company's, financial statement format and …

GAAP ( Generally Accepted Accounting Principles ... Generally Accepted Accounting Principles (GAAP) are basic accounting principles and guidelines which provide the framework for more detailed and comprehensive accounting rules, standards and other industry-specific accounting practices. For example, the Financial Accounting Standards Board (FASB) uses these principles as a base to frame their ...

Wiley Gaap 2017 Interpretation And Application Of ... Wiley Gaap 2017 Interpretation And Application Of Generally Accepted Accounting Principles Wiley Regulatory Reporting Author - - 2022-02-26T00:00:00+00:01 Subject: Kindle File Format Wiley Gaap 2017 Interpretation And Application Of Generally Accepted Accounting Principles Wiley Regulatory Reporting Keywords

GAAP - Generally Accepted Accounting Principles GAAP Principles in Accounting. Given below are 10 GAAP principles that frame the base of this accounting standard: #1 – Principle of Regularity: This is the foremost principle that assures that the accountant has adhered to Generally Accepted Accounting Principles norms. # 2 – Principle of Consistency: The company should adopt a single accounting standard like …

Generally Accepted Accounting Principles (United States ... The Financial Accounting Standards Board (FASB) published U.S. GAAP in Extensible Business Reporting Language (XBRL) beginning in 2008. Contents 1 History 2 Basic concepts 2.1 Assumptions 2.2 Principles 2.3 Constraints 3 Required departures from GAAP 4 Involved in development 5 Precedence of GAAP-setting authorities

Generally Accepted Accounting Principles (GAAP) Definition 10 Principles of GAAP There are 10 general concepts that lay out the main mission of GAAP. 1. Principle of Regularity The accountant has adhered to GAAP rules and regulations as a standard. 2....

PDF General Accepted Accounting Principles Accounting Reference Four Basic Principles The four basic principles in generally accepted accounting principles are: cost, revenue, matching and disclosure. The cost principle refers to the notion that all values listed and reported are the costs to obtain or acquire the asset, and not the fair market value. The

![Generally Accepted Accounting Principles [GAAP]](https://demo.dokumen.tips/img/414x310/reader026/reader/2021101408/5515912c497959f81d8b4d7e/r-1.jpg?t=1639422503)

0 Response to "42 generally accepted accounting principles"

Post a Comment